Noyau Modevo:

Noyau Modevo: An Easy Gateway to Investment Learning

Sign up now

Sign up now

Searching for investment education often feels disorganized. Information shows up everywhere, yet direction stays unclear. Investment education helps bridge that gap by turning curiosity into structured understanding. Noyau Modevo fits into this search by helping people reach educational firms that discuss learning topics, without shaping the education itself. The role stays focused on access, not instruction.

Many spend long periods reading articles, watching clips, or following discussions. Activity stays constant, but insight grows slowly. Investment education brings order to that effort. Concepts start linking together. Patterns appear across time. Noyau Modevo supports this process by opening the first line of communication, while keeping the learning neutral and free from pressure.

Ever felt busy learning but unsure what actually shifted? That usually happens when information lacks structure and conversation.

Learning often starts with basic ideas. Core concepts come first. Historical context follows. Behavior patterns surface later. Education builds step by step. It avoids shortcuts. Instead of rushing answers, it encourages reflection. Questions replace assumptions. Comparisons replace guesses. No topic receives special weight. No outcome is suggested.

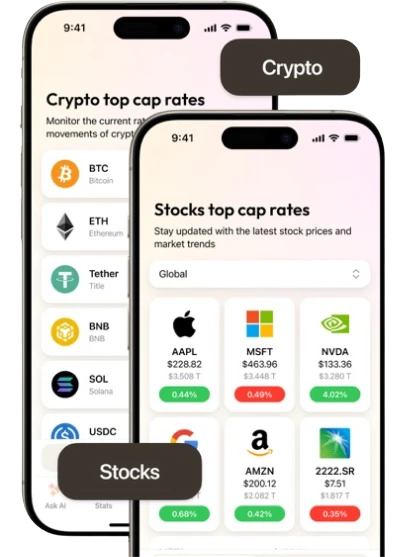

Investment education changes how thinking forms before it affects decisions. Ideas become clearer. Reactions slow down. Research gains focus. Past events still matter. Charts, cycles, and comparisons remain useful tools. Education helps connect these elements into a wider picture.

Noyau Modevo creates impact by removing friction at the very first step. Many people want investment education but struggle to reach the right starting point. The site simplifies access by connecting interest with independent educational firms. It does not shape learning or influence direction. Its impact comes from clarity. Communication opens. Pressure stays absent. Learning begins in a calmer, more deliberate way.

Noyau Modevo makes a difference by staying neutral. No opinions appear. No materials are promoted. Registration only enables contact using basic details such as a full name, email address, and phone number. Once that exchange happens, involvement ends. This distance protects independent thinking and allows education to remain personal. Understanding develops through conversation and reflection. Cryptocurrency markets are highly volatile and losses may occur.

Registration begins with a short and straightforward form. The purpose stays limited. It records interest in investment education and allows that interest to be shared with independent educational firms. No explanations, lessons, or examples appear at this stage. Learning does not begin here. The step exists only to open a line of communication.

After the form is completed, contact details move through a basic routing system. Educational firms may reach out directly to explain how their learning discussions are organized. Subjects vary. Formats vary. Response timing varies. No ranking takes place. No firm is promoted. No guidance is offered. Interaction develops through conversation, not automated steps.

Registration does not guide decisions or suggest actions. It does not remove uncertainty or shape outcomes. Learning depends on how information is reviewed, questioned, and compared over time. Independent research continues to matter. Responsibility remains with the individual once contact begins.

Noyau Modevo supports access to investment education by connecting individuals with independent educational firms. The site does not host lessons or provide instructional material. Its role stays limited to enabling communication. Education accessed through these connections focuses on understanding how markets function over time rather than directing outcomes. Topics often relate to structure, history, and behavior. The purpose remains explanatory. No actions are suggested. Learning discussions develop independently once contact begins.

Education introduced through these connections often starts with broad concepts. Educators explain how prices form, why trends slow or pause, and how participation and sentiment influence movement. Historical references such as 2000, 2008, or 2022 may be discussed to highlight repetition across different conditions. These examples support context building rather than prediction. The learning process emphasizes understanding before interpretation.

Another focus within investment education involves behavior. Educational discussions often examine how fear, confidence, and attention shift during different market phases. Charts, timelines, or past scenarios may be used to show repeated emotional patterns across decades. The aim stays awareness based. Learners use this material to observe rhythm and behavior instead of guessing direction. Outcomes remain uncertain. Cryptocurrency markets are highly volatile and losses may occur.

Education accessed through these connections frequently addresses limitations. Markets do not always behave logically. External events disrupt expectations. Educators explain why uncertainty cannot be removed and why risk awareness matters. This type of learning helps frame boundaries and avoid overconfidence. Understanding where knowledge stops becomes part of the educational process.

Many educational discussions encourage reflection over time. Past decisions are reviewed. Different viewpoints are compared. Learners revisit explanations after markets settle rather than during fast movement. This approach supports long term understanding. Independent research remains necessary. Conversations with qualified financial professionals help test understanding before decisions.

Access plays a central role in investment education. Learning often begins once people can reach the right conversations. Education accessed through proper channels helps reduce confusion caused by scattered opinions and constant updates.

Instead of adding noise, access supports explanation and context. The purpose stays focused on understanding, not instruction.

Access exists to support thinking, not to direct action.

One important topic within investment education is context. Learning works best when ideas are explained without pressure. Educational discussions focus on concepts, history, and behavior patterns rather than outcomes.

This helps learners understand how markets behave across different periods. Expectations stay realistic. Learning adjusts to individual pace. Education avoids shaping results.

Another key topic involves structure. Education helps organize information so it becomes easier to process. Instead of reacting to every change, learners group ideas and compare situations. Access begins with simple steps that allow dialogue to start. From there, structured learning replaces guessing. Attention shifts toward understanding rather than urgency.

Neutrality remains an important aspect of investment education. Learning works best when influence stays absent. No opinions are pushed. No material tells anyone what to do. Once access is established, educators and learners guide the discussion. This separation protects independent thinking and helps keep decisions personal.

A final topic involves limits. Investment education does not remove uncertainty or prevent mistakes. It supports awareness. Research continues. Questions become sharper. Comparing viewpoints adds balance. Conversations with qualified financial professionals help test understanding before decisions. Markets remain uncertain. Cryptocurrency markets are highly volatile and losses may occur.

Investment education supports awareness, not certainty. It does not remove doubt or prevent errors. Understanding grows through continued research and careful review. Questions become sharper over time. Comparing viewpoints helps maintain balance. Conversations with qualified financial professionals allow ideas to be tested before decisions. Markets remain unpredictable. Cryptocurrency markets are highly volatile and losses may occur.

Clear expectations help avoid confusion. Noyau Modevo supports access, not instruction.

It helps individuals reach independent educational firms that discuss investment learning topics. Education accessed through these connections focuses on explanation and context.

No actions are suggested. No outcomes are implied. The purpose stays learning focused, not result driven.

Noyau Modevo does not reduce risk or remove uncertainty. It does not forecast results. It does not offer learning material, signals, or guidance. No viewpoints appear on the site. No recommendations are made. The role stays limited to opening communication. Interpretation and decisions remain personal.

Market activity often shifts quietly before visible changes appear. Educational discussions explain why patience matters and why fast conclusions can mislead. Short pauses may come before movement, yet many pauses mean nothing at all. Learning supports observation rather than reaction.

Noyau Modevo enables access to these discussions by connecting individuals seeking investment education with independent educators. Registration opens communication only. Interaction stays simple, direct, and neutral.

Investment education begins with clear limits. Learning focuses on understanding how markets behave, not on directing decisions. Boundaries help separate explanation from action. Prices move. Phases change. Participation shifts. Education explains these processes without telling anyone what to do. This separation helps learners view market movement as information, not instruction.

Another key boundary involves interpretation. Education highlights behavior and decision making patterns without attaching outcomes. Past periods such as 2000, 2008, or 2022 often show how reactions repeat under different conditions. These examples provide perspective, not prediction. Boundaries keep learning grounded by preventing assumptions that history guarantees future results.

Noyau Modevo is built around a single function. The site supports connection, not education delivery. It helps individuals reach independent educational firms that discuss investment learning.

No lessons are hosted. No explanations appear. This clarity helps people understand the site’s purpose immediately and avoids mixed expectations from the start.

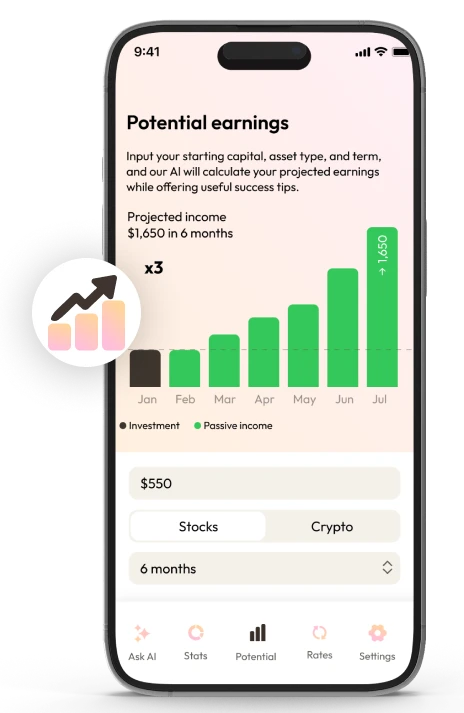

The process stays intentionally straightforward. Registration asks only for a full name, an email address, and a phone number. These details allow educational firms to respond directly. No additional steps appear. No choices are required. Keeping the process simple helps attention remain on learning conversations rather than forms or systems.

Noyau Modevo avoids shaping discussion in any way. No opinions are displayed. No viewpoints are promoted. Once contact begins, the site steps aside. Educational firms explain their own learning approach without outside framing. This distance helps preserve independent judgment and reduces external pressure during learning.

After communication starts, responsibility rests with the individual. Research continues independently. Questions develop over time. Comparing viewpoints adds perspective. Conversations with qualified financial professionals help test understanding before decisions. Markets remain uncertain. Cryptocurrency markets are highly volatile and losses may occur.

Confidence builds when boundaries remain visible. Noyau Modevo avoids influencing expectations or outcomes. The site opens communication and then remains silent. Learning stays personal. Decisions stay personal. This separation keeps the process transparent, focused, and grounded over time.

Investment education works smoothly when responsibilities stay distinct. Educators focus on explaining concepts, market history, and repeated behavior patterns without pointing toward specific actions.

Learners participate by reviewing information, raising questions, and choosing which areas deserve deeper attention. Defined structure reduces confusion. Curiosity replaces shortcuts. Learning becomes stronger when expectations stay grounded, limits remain clear, and each role stays separate without overlap.

Investment education helps people understand how markets behave over time. It explains structure, behavior, and historical context. Education supports clearer thinking, not certainty. Decisions still depend on personal judgment and continued research.

Noyau Modevo helps people connect with independent educational firms that discuss investment learning topics. The site does not provide lessons or materials. Its role is limited to enabling communication so educational discussions can begin elsewhere.

No. Investment education focuses on explanation rather than instruction. It helps frame information and highlight patterns without suggesting specific actions or outcomes.

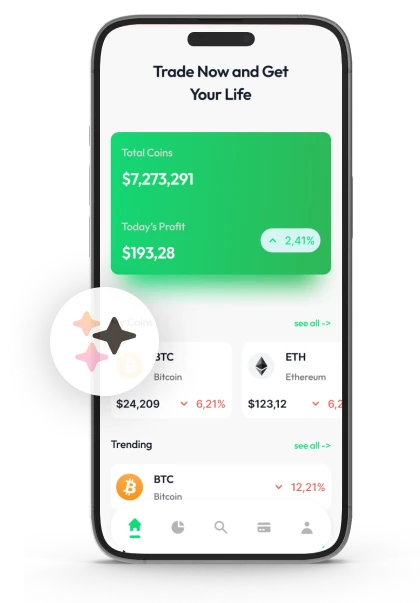

| 🤖 Enrollment Cost | Free of charge enrollment |

| 💰 Transaction Fees | No transaction fees |

| 📋 SignUp Procedure | Efficient and prompt registration |

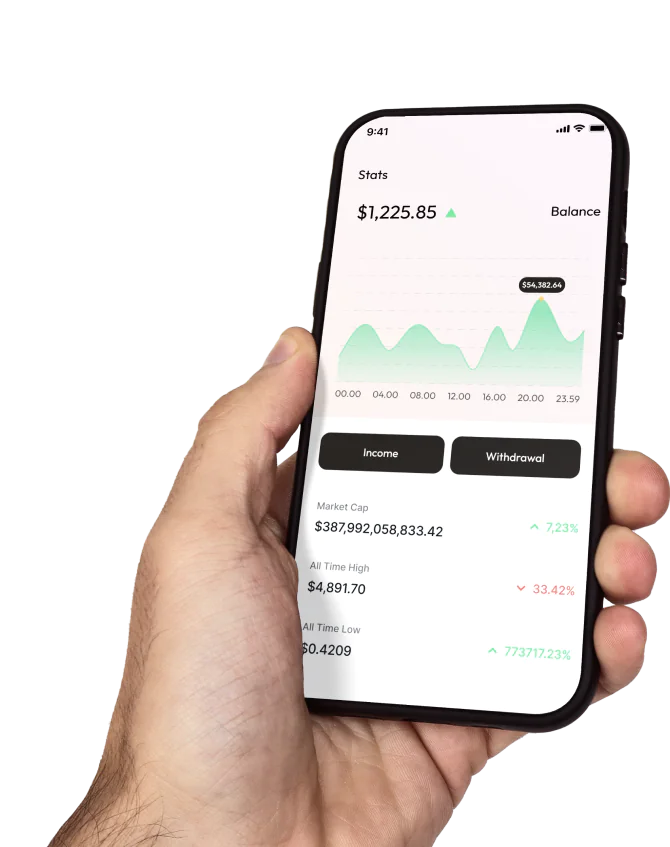

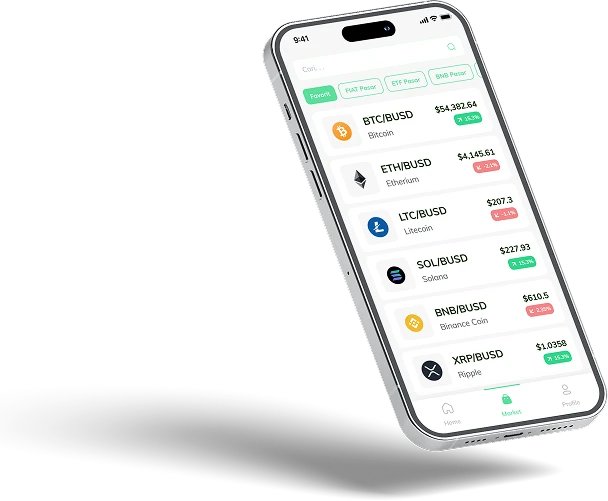

| 📊 Curriculum Focus | Courses on Cryptocurrencies, the Forex Market, and Other Investment Vehicles |

| 🌎 Accessible Regions | Excludes USA, available in most other regions |