Margen Finoble:

Margen Finoble: A Gateway to Crypto Education

Sign up now

Sign up now

Financial markets evolve rapidly, and emotional reactions often surface without delay. Education introduces distance between events and response. It allows individuals to examine market activity with reasoning instead of urgency or media influence. Past cycles demonstrate this clearly. The early 2000s technology decline, the global financial downturn, and multiple cryptocurrency surges and corrections all shared a common trait: uncertainty amplified losses, while preparation reduced their impact.

Learning changes how uncertainty is handled. Risk becomes something to recognise and account for rather than something to fear. Price movement begins to follow logic instead of appearing unpredictable. Potential loss is treated as part of preparation, not as an unexpected outcome. Some participants remain measured during rapid declines while others react immediately. That difference is often shaped by education.

Broader awareness adds stability. Traditional markets have faced repeated downturns over long timeframes, while digital assets typically move with greater speed and intensity. Education builds understanding before volatility emerges. Losses remain possible, but informed preparation helps reduce emotional strain and supports clearer interpretation.

Margen Finoble functions only as an introduction point. Its role is confined to connecting individuals seeking investment or cryptocurrency education with independent education providers that host learning conversations. The platform does not publish lessons, share viewpoints, or guide decisions. Its purpose begins and ends with access.

Educational engagement helps individuals slow reactions and arrange information more clearly. While uncertainty always remains, learning provides context for interpreting events. During times such as the global financial downturn or periods of sharp crypto price movement, confusion often intensified outcomes more than volatility itself. Margen Finoble supports education by enabling contact, not by shaping conclusions. Understanding develops through dialogue, independent research, and personal review. As clarity increases, emotional responses often ease even when markets remain unstable.

Educational conversations do not arrive with final answers. What individuals take away depends on the educator, the topic explored, and personal interpretation. Markets remain uncertain, and sentiment can change quickly. Learning encourages reflection and observation rather than immediate reaction. Some participants take notes, others ask questions, and many experience initial uncertainty. That early sense of confusion often marks the starting point of deeper understanding. Cryptocurrency markets are highly volatile, and losses may occur.

Margen Finoble is limited to making introductions. Once communication begins, its involvement ends. No materials are stored. No perspectives are promoted. No discussions are overseen. The platform maintains neutrality and steps away entirely. Education unfolds outside the site, guided by curiosity, independent inquiry, and open exchange, much like pointing out a path and allowing each individual to choose how to proceed.

Margen Finoble does not offer guarantees. It does not promise clarity, confidence, or improvement. Its purpose is access alone. Through connected education providers, learners commonly encounter explanations, discussion based formats, and structured approaches to examining market behaviour. Content varies by educator and subject. Value comes from engaging with ideas and perspectives rather than receiving fixed answers or prescribed conclusions.

Educational discussions frequently examine how markets respond over time. Topics may include reactions to news, shifts in momentum, or the importance of slower phases. Historical events are referenced to explain context and behaviour, not to forecast future outcomes. Learners often compare present conditions with earlier periods to understand differences rather than search for formulas to repeat.

Some materials focus on awareness and observation. Discussions may explore how attention moves, how narratives form, and why similar themes appear across cycles. Learners often apply this by slowing responses, recording observations, or revisiting explanations once volatility subsides. The objective remains perspective and awareness, not action.

Those unsure where investment education begins often gain the most value. Many want to learn but feel overwhelmed by constant commentary, opinions, and conflicting signals. Margen Finoble appeals to individuals seeking educational dialogue rather than instruction. It also suits those who prefer questioning before forming conclusions. New learners, returning participants, and cautious researchers all use the platform for the same reason: reaching education without pressure or direction.

Some users arrive with minimal familiarity, while others already follow markets and want broader context. Margen Finoble does not classify or rank participants by experience. Skill level is not a requirement. The platform connects learners with education providers that address topics at varying depths. Curiosity drives engagement, while progress develops through discussion, reflection, and continued research over time.

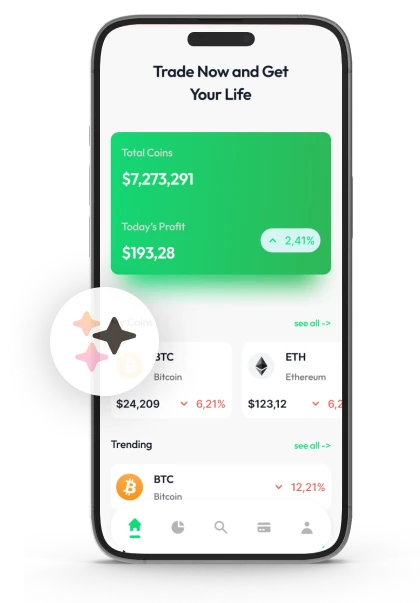

Registration establishes a clear line of contact—nothing beyond that. The process is intentionally simple to reduce friction. A name identifies the request, an email supports written communication, and a phone number allows follow up when conversation is better suited to voice. No educational material appears during sign up. No opinions are shared. The process resembles exchanging contact details at an event: a small step with a clear purpose.

Once contact is made, Margen Finoble steps away. Educational firms communicate directly. Topics, formats, and pacing are shaped through those exchanges. No content is filtered, and no outcomes are influenced. Learning continues through dialogue, independent research, and questioning. Often, clarity improves once questions reach the right source—access typically comes before understanding.

Early learners may interpret every update as a signal requiring action. Headlines can feel urgent. With education, information becomes organised. Individual data points lose intensity when viewed within historical context. Connections begin to form across timeframes. Reactions slow, and noise fades as understanding grows. Education does not determine outcomes; it helps arrange information into a clearer, more coherent structure.

Investment education often presents markets as networks of interaction rather than isolated movements. Price behaviour, participation levels, and activity tend to shift together rather than separately.

Momentum builds, pauses, and re emerges in repeating cycles that are never identical but often recognisable. Learning places emphasis on quieter intervals that frequently come before renewed engagement.

This wider lens feels closer to observing natural rhythms than reacting to individual fluctuations, helping short term movement fit within a broader frame of understanding.

Investment learning typically begins with fundamental concepts. These explain how markets function, what factors influence price movement, and how participants tend to react over time.

Many learners start by reviewing historical events, key terminology, and commonly observed frameworks. Building this foundation early helps prevent misunderstanding later. Understanding how the system operates is essential before attempting to evaluate results.

Educational approaches prioritise context rather than isolated numbers. Similar developments can produce very different outcomes depending on timing and surrounding conditions. For example, changes to interest rates in 2008 produced reactions that differed significantly from comparable adjustments in 2022. Context explains these contrasts. Learners are encouraged to assess situations comparatively instead of assuming repetition, which helps slow reactions and reduce flawed conclusions.

Learning often moves away from prediction and toward recognition. Behaviour repeats because human responses repeat. Concern frequently rises during downturns, while optimism tends to increase near market highs. Educational resources draw on historical cycles to illustrate these tendencies. Visual tools such as charts and timelines help learners notice emotional patterns. Awareness develops through recognising behaviour, not by estimating price levels.

Education places strong focus on limitations. Markets remain unpredictable, and unexpected developments can disrupt expectations. Learning clarifies what education can support and what remains beyond control. Risk is always present. Acknowledging uncertainty helps reduce overconfidence and highlights moments when restraint is more valuable than certainty. Understanding limits often offers greater protection than searching for definitive answers.

Educational processes encourage review rather than constant reaction. Revisiting earlier periods after emotions settle often deepens understanding. Comparing different viewpoints helps reveal blind spots. Returning to explanations after market movement supports long term clarity. Many learners gain more from a single thoughtful review than from continuous exposure to new material. Speaking with qualified financial educators before decisions supports balanced judgment. Cryptocurrency markets are highly volatile, and losses may occur.

Margen Finoble functions solely as a point of access, not as a teaching platform. Its role is limited to connecting individuals seeking investment education with independent education providers.

No lessons are hosted on the site, and no viewpoints are presented. The focus remains on opening communication rather than guiding learning.

This structure helps maintain realistic expectations and supports a neutral educational environment.

Learning often works best when it develops without urgency or pressure. Margen Finoble maintains a non intervention approach so educational conversations remain flexible and inquiry driven. Education providers explain concepts, participants ask questions, and meaning is formed independently. After an introduction is made, the platform withdraws, allowing learning to continue through discussion and personal research rather than instruction.

The platform does not review education providers, promote themes, or point toward specific choices or results. Materials are not filtered, prioritised, or compared. These boundaries help keep the process transparent. Education occurs outside the site, responsibility stays with the individual, and market uncertainty remains unchanged.

Defined limits help avoid confusion. Learners understand where the platform’s role concludes and where personal responsibility begins. Ongoing research and evaluating multiple viewpoints remain essential. Consulting qualified financial educators before making decisions supports balanced judgment. Throughout the entire process, Margen Finoble maintains a neutral position. Cryptocurrency markets are highly volatile, and losses may occur.

Margen Finoble does not affect how markets move. Price fluctuations, policy updates, shifts in sentiment, and unforeseen events unfold independently of the platform. Its function is limited to enabling access, not delivering instruction. By keeping distance from the learning itself, the platform allows educational conversations to begin without urgency, pressure, or direction.

Periods of sharp market movement often prompt renewed interest in education, as many people seek understanding before forming clearer questions. Margen Finoble supports a gradual entry into learning by keeping its process simple and clearly defined. Once contact is established, the platform’s involvement ends. No materials are presented, and no viewpoints are introduced. All educational exchanges take place beyond the site.

Educational resources frequently focus on human behaviour around markets rather than price movement alone. Discussions may explain why anxiety rises during downturns and why confidence strengthens during advances.

These responses recur over time. Learning highlights these patterns so reactions feel recognisable rather than unexpected.

Some educational materials explore how emotion influences judgment. Topics may include why urgency intensifies during rapid movement or why clarity fades amid uncertainty. Learners observe how headlines heighten emotion and how time restores perspective. Behavioural studies help explain why information often feels less intense after distance is created.

Educational discussions often examine how groups respond together. Materials may illustrate how shared sentiment influences momentum during rallies or sell offs, using historical periods as reference points. These examples help explain interaction rather than forecast outcomes. The focus remains comprehension, not prediction.

Some resources contrast initial reactions with later responses. New participants may interpret every movement as meaningful, while experienced learners tend to pause and observe. Education explains how familiarity grows through repetition. Over time, reactions slow, awareness deepens, and behaviour becomes easier to recognise before it shapes decisions.

Behaviour focused learning does not remove emotion or ensure calm choices. It helps individuals notice responses earlier. Reflection remains personal, and independent research continues to matter. Speaking with qualified financial educators before decisions supports balanced judgment. Cryptocurrency markets are highly volatile, and losses may occur.

Effective investment learning depends on clear role separation. Education providers focus on explaining ideas, behavioural patterns, and market context. Learners independently review information and decide how to interpret it.

When roles remain distinct, discussions stay practical and focused. Careful reading helps prevent misunderstanding, while asking thoughtful questions encourages deeper insight. Learning tends to improve when expectations remain realistic and boundaries are well defined.

Margen Finoble is intended for individuals interested in investment education who may feel uncertain about where to begin. Some join with broad questions, while others already follow markets and want additional context. Prior experience is not required. The platform suits those who prefer conversation and exploration rather than instruction. Curiosity and personal research shape the experience, not existing knowledge.

No decisions are made or guided on the platform. Margen Finoble does not suggest assets, timing, or methods. Its role ends at connection. Educational discussions occur externally, interpretation remains individual, and responsibility stays personal. Learning helps organise thinking, not direct choices.

Educational content varies by provider and discussion style. Some educators examine long term market behaviour, while others focus on risk awareness, information flow, or how narratives emerge. Historical examples are often used to explain context. These conversations aim to build understanding rather than forecast outcomes.