Rast Monvex:

Rast Monvex Connects Users to Crypto Education Opportunities

Sign up now

Sign up now

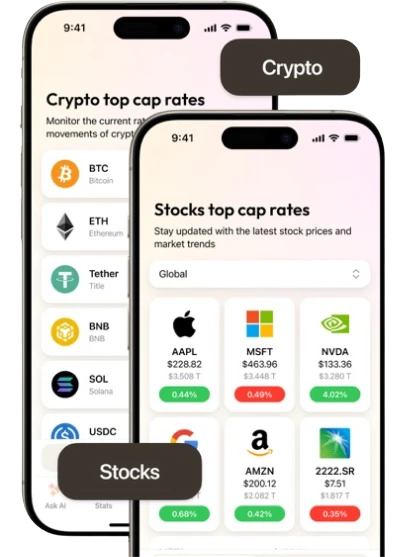

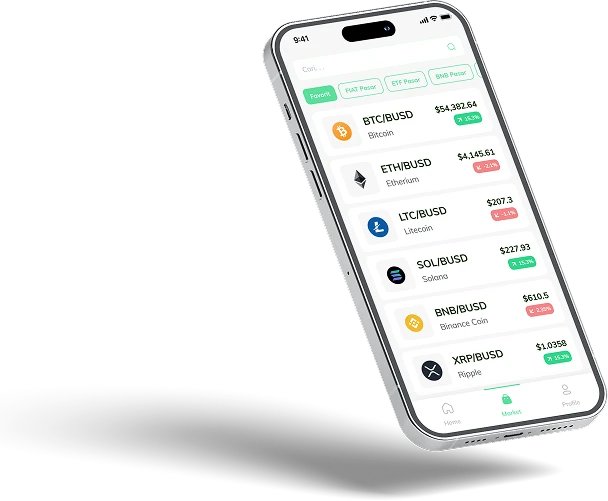

Rast Monvex serves as a gateway for those seeking to learn about digital asset markets. It doesn’t offer advice or instruction directly; instead, it connects users with external educational firms that explain how cryptocurrency market cycles evolve. This setup empowers users to explore learning opportunities tailored to their interests and learning style.

During registration, users provide basic contact information, enabling educational providers to share details about courses, teaching methods, and market insights without any endorsement, ranking, or filtering by Rast Monvex. The site does not evaluate the quality or outcomes of these programs.

By focusing solely on coordination, Rast Monvex stays neutral, leaving individuals responsible for judging whether the information fits their own goals. Cryptocurrency markets are volatile, and users should be aware that losses are possible.

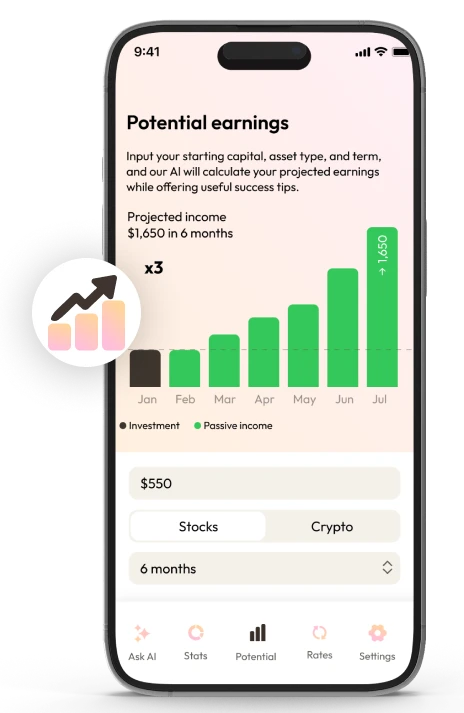

Learning about investing is a key step for anyone wanting to grasp how financial markets operate. Instead of giving direct advice or telling people what to do, investment courses usually break down essential concepts, explain industry terms, and review past market trends. This approach helps learners interpret financial information more effectively, especially in volatile markets influenced by a wide range of factors.

Exposure to investment education can help individuals see how narratives, data releases, and price movements interact in financial markets. While uncertainty is never fully removed, learning can guide users to ask more thoughtful, structured questions when analyzing market activity. Educational frameworks generally focus on identifying patterns, assessing risks, and understanding limitations rather than predicting specific outcomes.

Education cannot eliminate market risk or guarantee perfect interpretation. Markets are shaped by unpredictable events, sentiment shifts, and liquidity changes. The scope and depth of educational materials vary, and their value depends on how actively users engage with and evaluate the content.

Rast Monvex acts as a coordination hub rather than a classroom. It provides a steady, neutral framework while markets fluctuate. Users bring questions; educators receive interest signals. No instruction is delivered on the site itself. Like a railway station directing passengers to different trains, Rast Monvex enables learners to connect with educational opportunities without steering outcomes. This calm structure helps conversations and exploration begin naturally, free from pressure.

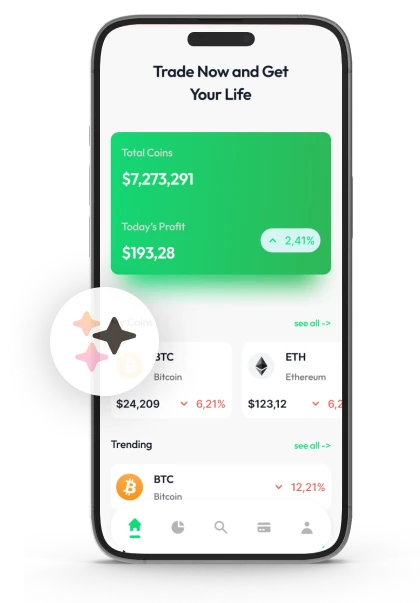

Registration starts the process for educational conversations. It’s brief and only collects essential contact details. No learning material or guidance appears at this stage. Full name identifies the request, email allows written replies, and phone supports follow up. The goal is purely to open a communication channel efficiently.

Only basic information is required to enable clear communication with educators. Missing or incorrect entries can delay responses. Many skip this step too quickly. Historical patterns show that hurried starts often cause confusion or missed context. Taking time ensures the process begins smoothly.

Registration does not provide lessons, advice, or educator rankings. It simply allows contact to occur. Users decide if conversations continue. Asking questions, conducting research, and consulting professionals are essential. Cryptocurrency markets remain volatile, and financial losses are always possible.

Investing education helps make sense of volatile markets. Prices swing, headlines shout, and emotions rise. Learning slows impulsive reactions by showing how markets often move in stages. For example, tech shares in 2000 surged, then fell sharply. History later revealed recurring patterns, showing that markets often repeat familiar behaviors.

Education teaches structure. Small market moves are seen within larger trends. Short term panic diminishes when framed against longer cycles. This doesn’t remove risk but helps manage it. In March 2020, rapid market drops caused fear, but those who studied prior crashes reacted with patience. Calm thinking acts like a seatbelt in volatile times.

Market movements repeat because human behavior does. Emotions like fear, hope, greed, and relief drive prices over time. Past cycles show familiar phases: expansion follows contraction, and confidence often fades before declines. Grasping why these patterns recur is more valuable than predicting exact timing.

Learning never ends. Markets evolve, tools change, but human reactions remain similar. Regular study helps maintain perspective, independent research sharpens judgment, and consulting financial professionals ensures balance. Continuous observation prepares learners to respond thoughtfully when conditions shift.

Investment education organizes facts for better insight. Headlines alone lack context; learning shows how events connect over time. A policy change may ripple months later. Education explains delays, highlights emotional reactions, and replaces panic with patterns. Structured thinking improves understanding but does not guarantee outcomes.

Investment education helps organize seemingly scattered market information. Lessons often show that markets move in phases rather than straight lines. Patterns such as accumulation, slowdown, and imbalance repeat across cycles, even when news headlines shift rapidly. This structured view improves overall comprehension.

Educators highlight that early market signs often seem unremarkable. Low trading volume, tight price ranges, and minimal excitement usually precede larger moves. Markets often “whisper” before making noticeable shifts. Recognizing these subtle cues prepares learners to interpret activity without overreacting.

Studying patterns over time allows learners to place short term moves in a broader context. Investment education doesn’t predict outcomes or guarantee profits. Instead, it encourages asking thoughtful questions and observing with patience, helping participants respond calmly to changing market conditions.

Engagement on Rast Monvex occurs via open discussions with independent educators, without rankings, recommendations, or content created by the site. Knowledge develops through conversation alone. This independence lets learners explore ideas freely, participate without pressure, and understand concepts at a pace suited to their personal interests and comfort.

The platform exists solely to enable communication. Rast Monvex does not provide instruction, influence decisions, or evaluate educators. Learning happens entirely through direct dialogue with independent firms. By remaining neutral, the site fosters autonomy, clarity, and organic exploration, allowing learners to engage without imposed structure or expectations.

The site uses a clear system to route requests efficiently. Information enters, signals move correctly, and educators receive inquiries without distortion or prioritization. During sharp market swings, like in 2022, this structured layout reduced confusion. Even simple visual organization can prevent disorder when paths bend unexpectedly.

Short term market moves can distract attention, while longer patterns matter more. Rast Monvex keeps interactions consistent across shifting conditions. This stable flow allows conversations to develop calmly. There is no rush, no added urgency. Individuals choose how deeply to engage and how much context to explore.

Investment education helps organize market concepts that can feel disjointed. Courses focus on phase based movements rather than straight lines, showing accumulation, slowdown, and imbalance across multiple cycles. Even as headlines change, recognizing these recurring patterns improves comprehension and helps learners see the bigger picture.

The site maintains clarity by keeping access and education separate. This approach ensures conversations remain focused and prevents unrealistic expectations. Learners are encouraged to conduct research, ask questions, compare perspectives, and consult financial professionals before making decisions, fostering balanced and informed understanding.

Investment education clarifies concepts rather than providing guaranteed results. Access to learning does not ensure success or favorable outcomes. Markets move due to emotion, policy changes, liquidity, and unforeseen events. Education helps interpret these factors but cannot control or predict results.

Education offers context, not certainty. Two learners reviewing the same material may draw different conclusions. Learning enhances awareness and analytical thinking rather than forecasting exact outcomes. Understanding patterns and market logic strengthens judgment without promising accuracy or specific gains.

Educational discussions focus on ideas, historical behavior, and market patterns. They do not eliminate uncertainty or dictate future market direction. Individual decisions, external events, and market dynamics ultimately determine outcomes, making education a guide for informed observation rather than a tool for guaranteed results.

Understanding market behavior begins with education, not immediate action. Early shifts in trends or sentiment often occur before numbers fully reflect them. Educational discussions clarify how momentum, pauses, and changing sentiment develop in stages, giving learners context to interpret movements more thoughtfully.

Rast Monvex supports learning by connecting individuals interested in investment education with independent educators. This link allows users to explore common market phases and study patterns without receiving advice or instruction on what decisions to make, maintaining a neutral and structured approach to educational engagement.

To initiate this connection, users must register by providing a full name, email, and phone number. No educational materials are delivered during registration. This step exists purely to allow direct communication with educators, ensuring learners can engage without confusion while keeping expectations clear and the process orderly.

Education doesn’t alter markets; markets influence people, and learning changes how they respond. Investment education helps slow decisions, assess risk, and question assumptions when prices move rapidly, encouraging thoughtful action rather than emotional reactions during volatile periods.

Investment education emphasizes understanding key drivers like policy shifts, capital flows, and sentiment. These forces repeat over time. Learning highlights patterns, explains market compression and expansion, and reshapes expectations. Research, comparing perspectives, and consulting financial professionals support clearer, balanced judgment.

Security is crucial when sharing personal details like names, emails, and phone numbers. Any system handling this information requires strong safeguards. Proper data management reduces misuse, prevents confusion in communication, and ensures that users can interact with educators safely and confidently.

Think of it like locking your door before leaving home. While it doesn’t eliminate every risk, it significantly lowers unnecessary exposure. Strong precautions provide peace of mind, which often goes unnoticed until an issue arises, highlighting the importance of careful handling and robust protection measures.

Information provided during registration is used solely to enable contact between learners and educators. No data is sold or displayed publicly. Maintaining clear boundaries ensures focus stays on educational discussions rather than privacy concerns. Users should still exercise caution and review what they share carefully.

Educational content is not hosted on the site. Instructors share insights, perspectives, and learning approaches directly during interactions. Lessons often cover market behavior, risk, and historical trends. The focus is on explaining patterns, not predicting future prices or specific dates, helping learners understand context rather than forecast outcomes.

Content differs across educators some emphasize long term cycles, others short term behavior. Comparing multiple perspectives builds understanding. Independent research, questioning assumptions, and consulting financial professionals before decisions ensures a balanced approach and improves clarity when interpreting educational material.

Security also depends on user behavior. Sharing only necessary details, reading messages carefully, and asking clear questions reduces miscommunication. Think of it like lending a book the material matters, but so does who receives it. Clear expectations foster trust and ensure educational interactions remain effective.

A wider market view comes from observing trends over time rather than reacting to single moments. Rast Monvex supports this perspective by maintaining consistent access as market activity accelerates or slows. This steady structure lets learners focus on educational discussions instead of getting distracted by short term volatility or noise.

Think of observing traffic from a hill rather than standing at a crowded intersection. Patterns become easier to recognize, and sudden stops or surges make more sense. Viewing from a distance allows learners to interpret activity calmly, improving comprehension even when market conditions appear chaotic or fast moving in the short term.

Registration allows users to connect with educators through a brief process. Learners provide a full name, email, and phone number to ensure direct responses. No lessons or advice are provided at this stage. Think of it like filling a visitor badge before entering a conference, access is organized, simple, and focused.

Investment education does not eliminate emotions. Instead, it helps learners recognize and understand them. Education explains why fear spikes during declines and confidence surges near highs. Awareness slows impulsive reactions, providing a calmer perspective while emotions continue to influence decisions in volatile markets.

Rast Monvex connects individuals seeking investment education with independent educators. It does not provide instruction or advice. Its role is coordination only, acting as a neutral meeting point. Questions reach educators, and discussions occur elsewhere. Like a library notice board, it directs without influencing the content of conversations.